Bharat stumped on easy methods to shorten PhonePe and Google dominance in bills

Bharat is dealing with a dilemma in implementing long-delayed regulations to curb the dominance of PhonePe and Google Pay within the nation’s ubiquitous UPI bills community, which processes over 10 billion transactions per 30 days.

The Nationwide Bills Company of Bharat (NPCI), a unique unit of the central attic, needs to cap marketplace percentage of any participant at 30% within the Unified Bills Interface ecosystem. With Paytm, the 0.33 prominent participant at the UPI charts, fighting for its survival, the NPCI faces a urgent distinctive problem in getting PhonePe and Google Pay to decrease their marketplace percentage: It doesn’t understand how to.

The NPCI officers imagine there may be technical barrier to reaching the purpose and feature sought trade avid gamers in contemporary quarters for concepts, two assets regular with the status mentioned. The NPCI, which delayed enforcing the rules to 2024, declined to remark Tuesday.

Its catch 22 situation has come into focal point once more nearest a parliamentary panel requested Fresh Delhi terminating generation to assistance home fintech companies to counter the dominance of PhonePe and Google Pay. This got here nearest the central attic directed Paytm, the third-biggest participant, to restrain a number of operations at Paytm Bills Storagefacility, the workman entity that processes transactions for the monetary products and services workforce.

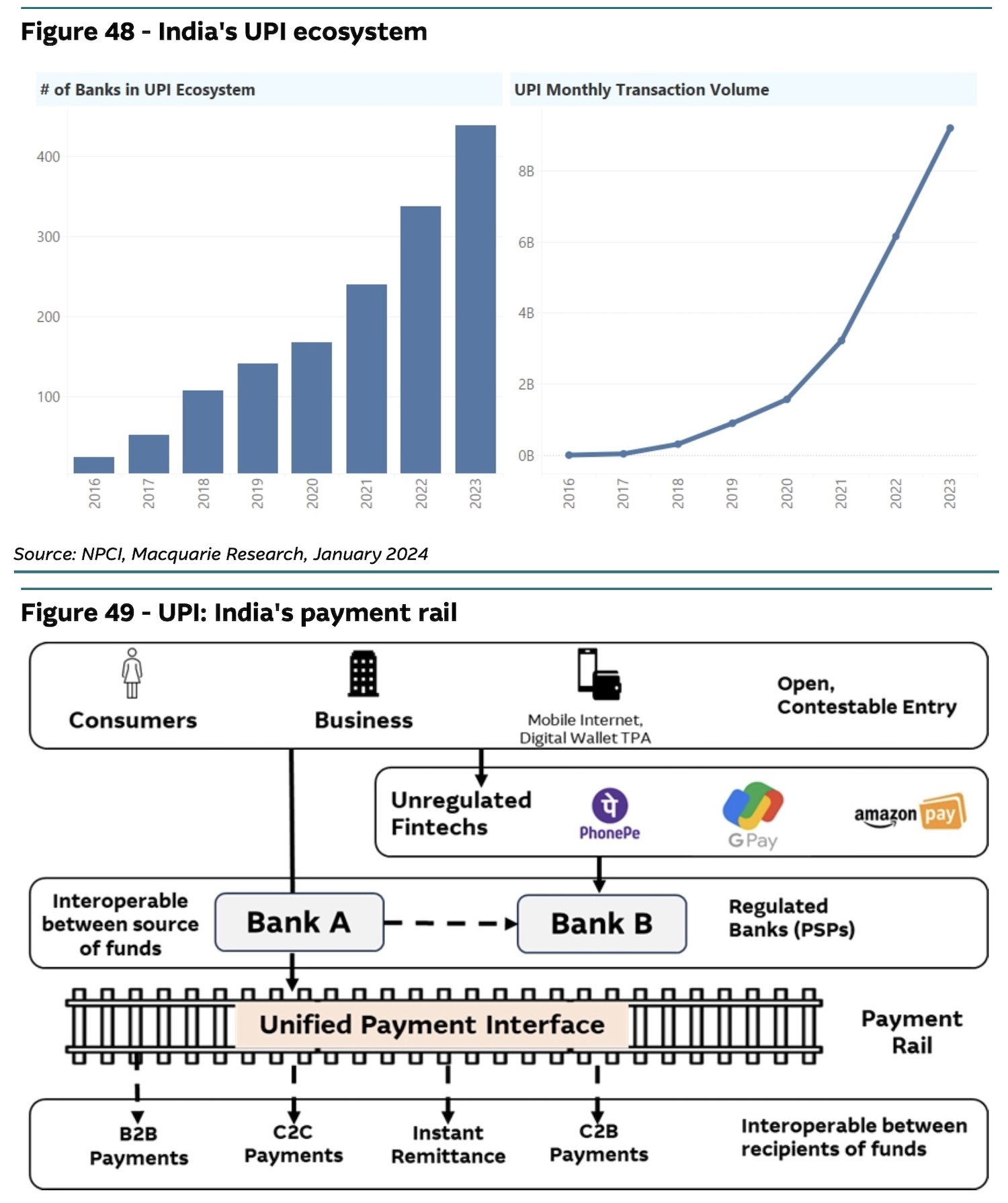

Bharat’s real-time virtual bills machine, UPI, has radically remodeled the rustic’s bills park since its foundation in 2016. The UPI community options just about 492 banks, 70 million traders and a per 30 days transaction quantity exceeding 10 billion.

Symbol credit: Macquarie

Brokerage company Macquarie on Tuesday dramatically cut its 12-month price target on Paytm over issues that its lending companions in addition to consumers would possibly shed the platform. Macquarie, whose worth goal implies a valuation of $2.1 billion for Paytm (allowing for that Paytm has a $1 billion in money steadiness), mentioned the Noida-headquartered company is “fighting for its survival.”

Paytm’s additional lack of marketplace percentage would get advantages the lead two, trade executives cautioned. Bringing up professional knowledge, the parliamentary panel mentioned PhonePe had 47% and Google Pay 36% marketplace percentage right through October-November 2023.

Business executives mentioned the one means for PhonePe and Google Pay to agree to the 30% cap is to restrain including unutilized customers. Within the period in-between, PhonePe continues to spend on advertising and marketing to obtain extra percentage.